Why Tapdata

Products

Pricing

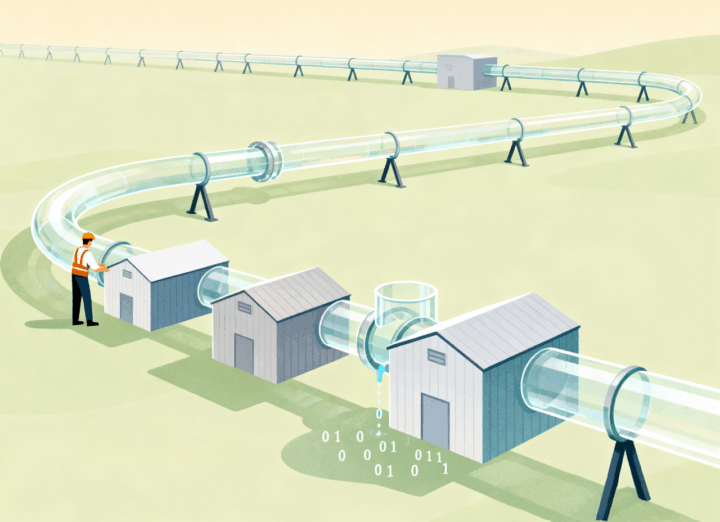

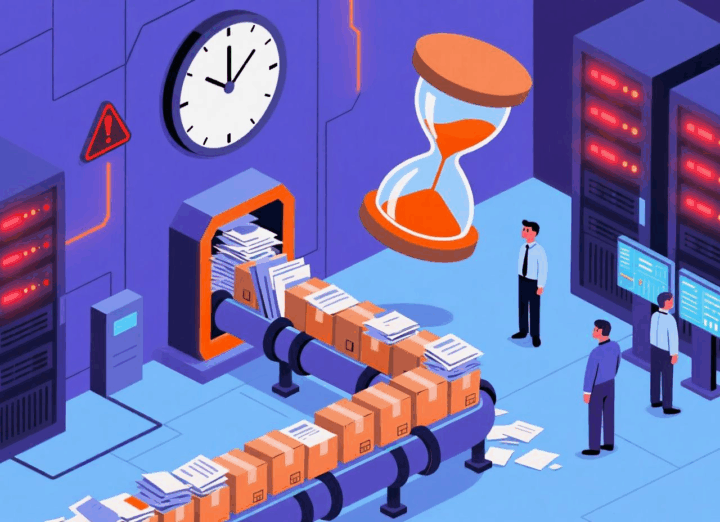

Tapdata Live Data Platform

The Tapdata Live Data Platform visualizes the construction of an enterprise real-time data service platform in a very short period of time, enabling low-cost implementation of Data as a Service.

Community

GitHub

Resource

Documentation

White Papers

Blogs

Blogs

Technical Analysis

Technical Analysis

Application Scenario

Application Scenario

Best Practices

Best Practices

News information

News information

Quick Start Video

Quick Start Video

Live playback

Live playback

Product Demo

Product Demo

Quick Get Start

Quick Get Start

Preparation

Preparation

User Guide

User Guide

Common Problem

Common Problem